Legacy Giving

INVEST IN THEIR FUTURE. BUILD YOUR LEGACY.

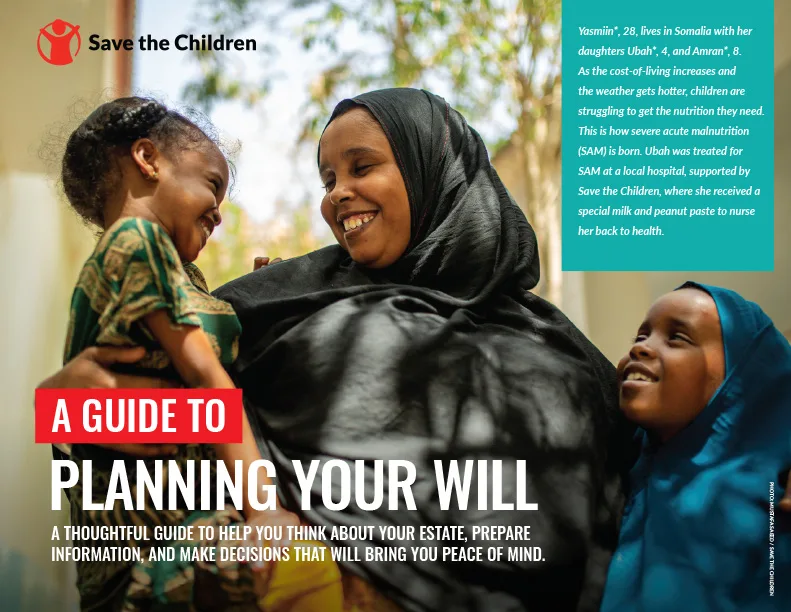

A legacy gift to Save the Children lets you invest in a better future for children for generations to come and ensures that your legacy and values live on. By including us in your estate plans, you will make a lasting impact on children’s health, education, and protection—where and when they need it most. Legacy giving can also provide financial benefits, like tax savings and increased flexibility in managing your assets. Our FREE Will Guide kit can help you get started.

LET’S CONNECT

Our Philanthropy team would be happy to discuss your legacy giving goals, whether for yourself or as an advisor. Please contact us to:

- • Explore how you can invest in a better future for children and build your legacy.

- • Let us know you have included a gift to Save the Children in your Will.

- • Let us know that Save the Children is no longer included in your Will.

leavealegacy@savethechildren.ca | +1-800-668-5036

REQUEST YOUR FREE WILL GUIDE KIT

Use the form below to request your digital copy today and learn practical insights to help you get started planning your Will. We’ll send you a digital download of the Will Guide kit as PDF.

RELATED STORIES

Why you need a Will and how to make one

Three reasons you should leave a charitable gift in your Will

How the gift of Life Insurance lets you give more for less

What is a charitable remainder trust and is it right for you?