Donating publicly traded securities or mutual funds allows you to increase your impact, helping to bring real change to the lives of children around the world, ensuring they grow up healthy and happy.

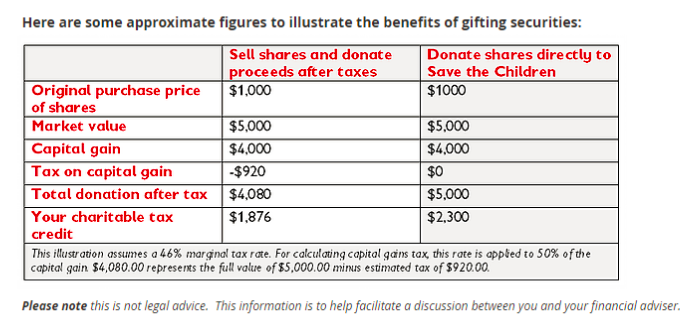

By donating publicly traded securities, you eliminate the capital gains tax that you’d have to pay if you sold the securities and then donated the proceeds. You will receive a charitable tax receipt for your donation – providing you with a double tax benefit.

You can give now, or as part of your estate and will planning.

Simple and Convenient – Securities are easy to transfer. Your broker simply transfers the shares from your account to our Save the Children’s brokerage account.

Strategic Giving – This is an opportunity to give strategically, ultimately giving more at no extra cost.

Impact – The opportunity to make a significant gift; increasing the impact of your gift to help children who have gone through, what no child should ever have to experience.

Tax Advantages – Double tax benefits by eliminating the capital gains tax and receiving a tax receipt to reduce taxes on other sources of income

HOW IT WORKS

Step 1 – Download the ‘Letter of Instruction’ form. Or contact us directly using the information below and ask for a copy.

Step 2 – Fill out the form with all of the necessary information and send a copy to your broker and Save the Children. Your broker will then arrange the transfer of shares to Save the Children. All necessary information you and your broker require to complete the transfer of shares is on the form.

Step 3 – Once the shares have been received by Save the Children, a tax receipt will be issued to you for the fair market value. This being the closing price, on the date the shares are received by Save the Children.

If you have any questions, please contact the Planned Giving Officer, Kathryn Lara at: 1-416-221-5501 ext. 265 , or email leavealegacy@savethechildren.ca

*If you are thinking about transferring assets that have appreciated, you should seek expert advice from a tax specialist, your broker or qualified financial adviser.